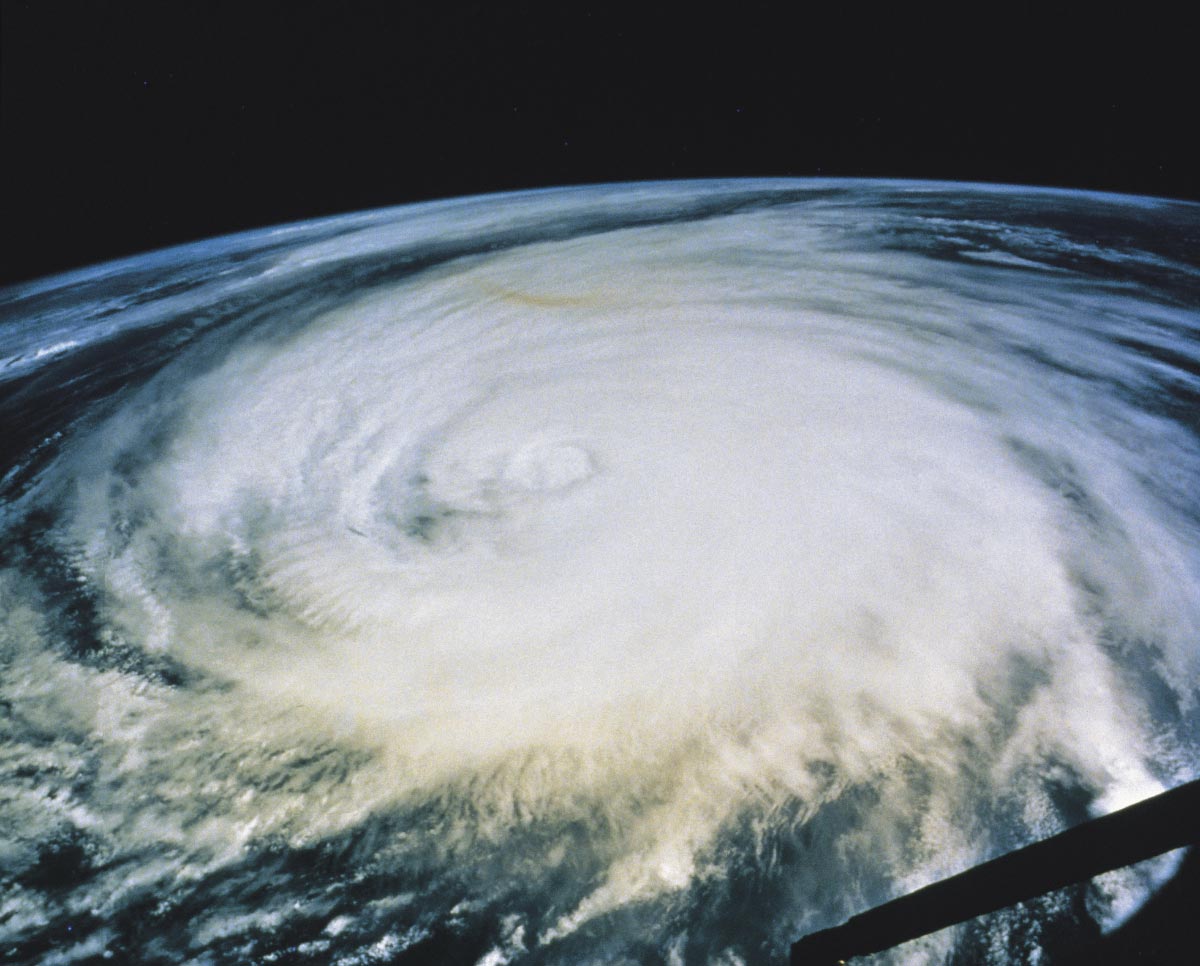

CROP COLLAPSE: Florida citrus crops DESTROYED by Hurricane Ian

10/05/2022 / By Ethan Huff

Orange juice prices reached a nearly six-year high this week following the devastation to citrus crops caused by Hurricane Ian.

Orange and other citrus groves across the southwestern region of the Sunshine State took a major hit from Ian, which as we know caused serious flooding and wind damage.

Ray Royce, executive director at the Highlands County Citrus Growers Association, told Bloomberg that anywhere from 20 percent to 80 percent of fruit throughout the region was damaged, depending on the location.

Because many roads and bridges are still impassable, a complete assessment of citrus groves is still not possible. Royce is just making estimates, suggesting that some areas might be mostly okay while others “could have lost it all.”

Alico Inc., one of the largest citrus producers in the United States, said it will take at least two years to get production back to pre-Ian levels. The company reported a “significant drop of fruit from trees” due to high winds throughout the region.

Ian was rough on citrus in SW Florida pic.twitter.com/FBRe5zm7wI

— Gene McAvoy (@SWFLVegMan) October 3, 2022

Alico issued a press release stating that supplies to Tropicana, Peace River, Cutrale, and Florida’s Natural – these are among the top orange juice processors in the U.S. – will continue with “all available fruit during the upcoming harvest season, which will begin later this year.”

Are citrus prices about to squeeze?

Mixon Fruit Farms, another citrus producer located near Tampa, indicated that crop surveying is currently underway to determine the status of both orange and grapefruit trees.

“It looks like about 30 percent of the fruit was knocked off the tree,” said Janet Mixon, the company’s owner.

Not only did Ian hit the fertilizer hub of Florida, but it also devastated a major citrus-producing region of the state.

Some 375,000 acres of citrus trees were right in the storm’s path, it turns out. We will soon find out just how many of these acres were damaged or destroyed by the storm – and what that will mean for the future of citrus availability throughout the country.

Media reports are already talking about the prices of orange and other citrus juices “squeezing” in the near future. Orange juice prices jumped by as much as 5.2 percent before settling at 3.6 percent higher at $1.9825. This is the highest price for orange juice since December 2016.

Even before Ian made landfall, Florida’s citrus crop yields were already slated to be the smallest since World War II – how convenient since we are now on the verge of World War III.

“Breakfast inflation will get costlier as orange juice prices continue to rise,” reported Zero Hedge. “Maybe the Fed should see if their money printers can print oranges.”

In the comment section, numerous people pointed out that the whole situation is suspect, to say the least.

“Fruit seller tells you a tree lost 30% of the fruit. Same orchardist knocks weak fruit off to produce viable fruit,” one of them wrote about the possible deception embedded into the citrus squeeze narrative.

“Missing from the official reporting: how much will the remaining fruit produce by harvest in a few months? More or less the typical amount.”

“I wonder how much of the fruit on the ground is worth picking up?” wrote another.

Someone else explained how the Fed’s money printing spree is essentially buying “all labor and all commodities” as prices for everything skyrocket.

“You are a slave,” this person added about the reality of what is transpiring.

As the world unravels in preparation for the completion of the 70 Weeks of Daniel, we will keep you informed about the latest developments at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

citrus, climate, crops, damage, devastation, disaster, fertilizer, food collapse, food scarcity, food supply, fruits, grocery, harvest, hurricane, Hurricane Ian, inflation, products, supply chain, world agriculture

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

WorldAgriculture.News is a fact-based public education website published by WorldAgriculture News Features, LLC.

All content copyright © 2022 by WorldAgriculture News Features, LLC.

Contact Us with Tips or Corrections

All trademarks, registered trademarks and servicemarks mentioned on this site are the property of their respective owners.